In recent years, the financial markets have witnessed a remarkable transformation, largely driven by the rise of artificial intelligence (AI). This technology has revolutionised trading by enabling traders to analyse vast amounts of data at unprecedented speeds. AI algorithms can process information from various sources, including news articles, social media, and historical price data, allowing traders to make informed decisions based on real-time insights.

The ability to identify patterns and trends that may not be immediately apparent to human traders has given AI a significant edge in the fast-paced world of forex trading. Moreover, AI has facilitated the development of sophisticated trading bots that can execute trades autonomously. These bots are programmed to follow specific strategies and can react to market changes in milliseconds, far surpassing human capabilities.

As a result, traders are increasingly relying on AI-driven tools to enhance their trading strategies and improve their overall performance. The integration of machine learning techniques has further enhanced these systems, enabling them to learn from past trades and adapt to changing market conditions. This evolution signifies a shift towards a more data-driven approach in trading, where intuition is increasingly being replaced by algorithmic precision.

Summary

- AI is revolutionising trading by enabling faster and more accurate decision-making processes.

- Blockchain technology is transforming trading by providing secure and transparent transaction records.

- Big data plays a crucial role in helping traders make informed decisions by analysing large volumes of information.

- ESG factors are becoming increasingly important in trading as investors seek to align their values with their investment decisions.

- Global events have a significant impact on trading signals, highlighting the need for traders to stay informed and adaptable.

The Impact of Blockchain Technology on Trading

Blockchain technology has emerged as a game-changer in the financial sector, particularly in trading. Its decentralised nature offers a level of transparency and security that traditional trading systems often lack. By providing a tamper-proof ledger of transactions, blockchain technology ensures that all trades are recorded accurately and can be verified by all parties involved.

This transparency not only builds trust among traders but also reduces the risk of fraud and manipulation, which have historically plagued the financial markets. Furthermore, blockchain technology has paved the way for the development of smart contracts, which automate the execution of trades based on predefined conditions. This innovation streamlines the trading process, reducing the need for intermediaries and thereby lowering transaction costs.

As more traders and institutions recognise the benefits of blockchain, its adoption is expected to grow, leading to a more efficient and secure trading environment. The potential for tokenisation of assets also opens up new avenues for trading, allowing for fractional ownership and increased liquidity in previously illiquid markets.

The Role of Big Data in Making Informed Trading Decisions

In the age of information, big data has become an invaluable asset for traders seeking to gain a competitive edge. The sheer volume of data generated daily presents both challenges and opportunities for traders. By harnessing big data analytics, traders can uncover insights that inform their trading strategies and enhance decision-making processes.

This involves analysing not only historical price movements but also macroeconomic indicators, geopolitical events, and even consumer sentiment. The ability to process and analyse big data allows traders to identify correlations and trends that may influence market movements. For instance, understanding how economic indicators such as unemployment rates or inflation impact currency values can provide traders with a clearer picture of potential market shifts.

Additionally, sentiment analysis derived from social media platforms can offer real-time insights into market psychology, enabling traders to anticipate price movements before they occur. As technology continues to evolve, the integration of big data analytics into trading strategies will likely become increasingly sophisticated, further enhancing traders’ ability to make informed decisions.

The Importance of Environmental, Social, and Governance (ESG) Factors in Trading

In recent years, there has been a growing recognition of the importance of environmental, social, and governance (ESG) factors in trading decisions. Investors are increasingly seeking to align their portfolios with their values, leading to a surge in demand for sustainable investment options. This shift is not merely a trend; it reflects a fundamental change in how traders assess risk and opportunity in the markets.

Incorporating ESG factors into trading strategies can provide valuable insights into a company’s long-term viability and potential for growth.

For instance, companies with strong environmental practices may be better positioned to navigate regulatory changes related to climate change, while those with robust governance structures may be less susceptible to scandals or mismanagement.

As more traders recognise the financial implications of ESG factors, we can expect an increasing number of investment products that prioritise sustainability.

This evolution signifies a broader shift towards responsible investing, where financial returns are balanced with social impact.

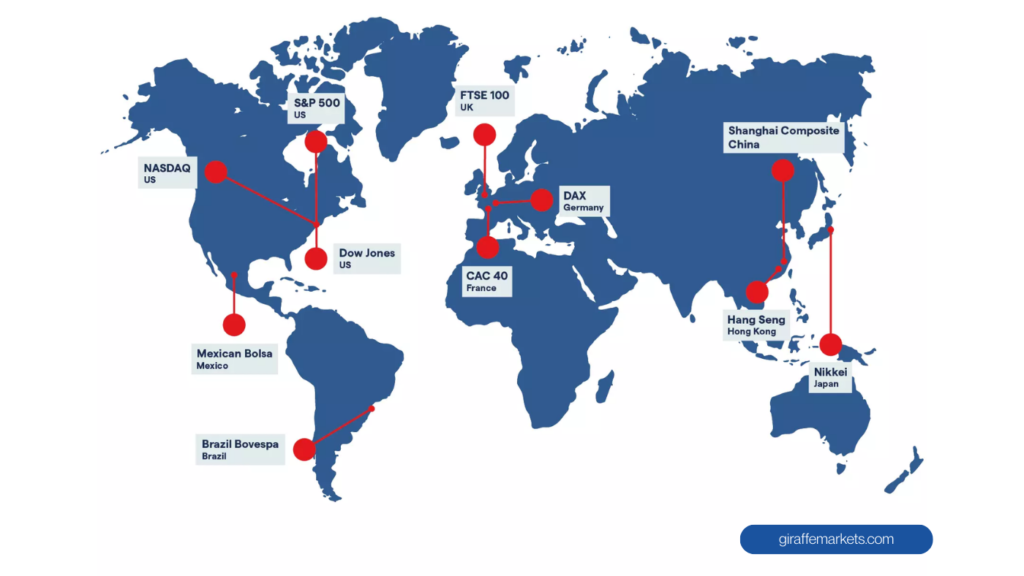

The Influence of Global Events on Trading Signals

Global events have always played a crucial role in shaping market dynamics, but their influence has become even more pronounced in today’s interconnected world. From geopolitical tensions to natural disasters, these events can create volatility that traders must navigate carefully. Understanding how global events impact trading signals is essential for developing effective strategies in an ever-changing landscape.

For instance, political instability in a country can lead to currency depreciation as investors seek safer assets.

Similarly, economic sanctions or trade agreements can significantly affect currency pairs and commodity prices. Traders who stay informed about global events and their potential implications are better equipped to anticipate market movements and adjust their strategies accordingly.

In this context, real-time news feeds and analytical tools have become indispensable resources for traders looking to capitalise on opportunities arising from global events.

The Evolution of Trading Strategies in 2025

As we look ahead to 2025, it is clear that trading strategies will continue to evolve in response to technological advancements and changing market conditions. The integration of AI and machine learning will likely lead to more sophisticated algorithmic trading strategies that can adapt in real-time to market fluctuations. Traders will increasingly rely on predictive analytics to forecast price movements based on historical data and current trends.

Moreover, the rise of social trading platforms will enable traders to share insights and strategies more easily than ever before. This collaborative approach can enhance learning opportunities for novice traders while providing experienced traders with valuable feedback on their strategies. As the trading landscape becomes more competitive, the ability to leverage collective knowledge will be a key differentiator for success.

The Growing Significance of Cryptocurrencies in Trading

Cryptocurrencies have emerged as a significant asset class in recent years, attracting both retail and institutional investors alike. Their decentralised nature and potential for high returns have made them an appealing option for traders seeking diversification beyond traditional assets. As cryptocurrencies continue to gain mainstream acceptance, their significance in trading is expected to grow even further.

The volatility inherent in cryptocurrency markets presents unique opportunities for traders willing to embrace risk. However, this volatility also necessitates a robust risk management strategy to protect against sudden price swings. Additionally, as regulatory frameworks around cryptocurrencies evolve, traders must stay informed about potential impacts on market dynamics.

The increasing integration of cryptocurrencies into traditional financial systems will likely lead to new trading products and strategies that capitalise on this burgeoning asset class.

The Future of Algorithmic Trading in 2025

Looking towards 2025, algorithmic trading is poised for further growth and sophistication. As technology continues to advance, we can expect algorithms to become more intelligent and capable of processing complex datasets with greater accuracy. This evolution will enable traders to implement more nuanced strategies that take into account a wider range of variables.

Furthermore, the integration of AI with algorithmic trading will likely lead to the development of self-learning systems that can adapt their strategies based on market conditions without human intervention. This shift could redefine the role of human traders, who may focus more on strategy development and oversight rather than execution. As algorithmic trading becomes increasingly prevalent, regulatory considerations will also come into play, necessitating a balance between innovation and oversight to ensure market integrity.

In conclusion, the landscape of trading is undergoing profound changes driven by technological advancements such as AI, blockchain technology, big data analytics, ESG considerations, and the rise of cryptocurrencies. As we move towards 2025, traders must remain agile and adaptable in order to navigate this evolving environment successfully. Embracing these changes will not only enhance trading performance but also contribute to a more sustainable and responsible financial ecosystem.

FAQs

What are trading signals?

Trading signals are indicators or suggestions that help traders make decisions about buying or selling assets in the financial markets. These signals are generated through technical analysis, fundamental analysis, or a combination of both, and are used to identify potential trading opportunities.

What are the top signals for trading in 2025?

The top signals for trading in 2025 may include trend-following indicators such as moving averages, momentum indicators like the Relative Strength Index (RSI), and volatility measures such as the Average True Range (ATR). Additionally, fundamental signals related to economic data, geopolitical events, and company earnings reports may also play a significant role in trading decisions.

How can traders use trading signals effectively?

Traders can use trading signals effectively by incorporating them into their overall trading strategy, conducting thorough analysis, and considering risk management principles. It’s important for traders to understand the strengths and limitations of different signals and to use them in conjunction with other forms of analysis to make informed trading decisions.

Are trading signals guaranteed to be accurate?

No, trading signals are not guaranteed to be accurate. While they can provide valuable insights into potential market movements, they are not foolproof and should be used in conjunction with other forms of analysis and risk management techniques. It’s important for traders to exercise caution and to not rely solely on trading signals when making trading decisions.